Drake Hampton

Mar 24, 2022 16:46

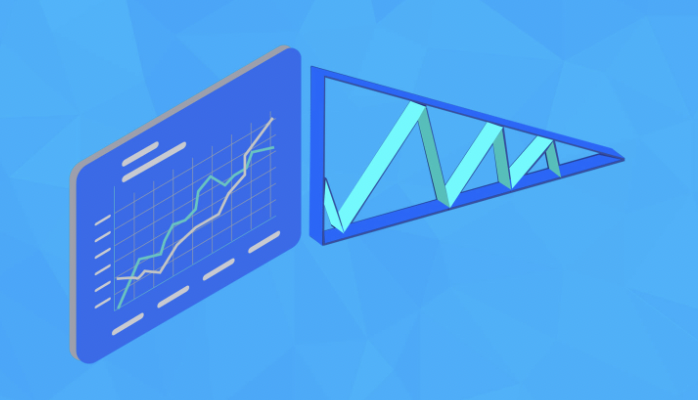

Pennants are continuation patterns that traders use to forecast future market moves in the FX market. While the Pennant pattern is similar to the triangle pattern, there are some critical distinctions that traders should be aware of.

This article will teach you how to identify Pennant chart patterns, what they signify, how they are formed, and, most importantly, how to utilize them to conduct more effective trades.

A Pennant pattern is a continuation chart pattern that occurs when a security has a significant upward or downward movement, followed by a brief consolidation period before continuing in the same direction. The pattern is formed by multiple forex candlesticks and resembles a little symmetrical triangle called a Pennant. Pennant patterns are often classified as bearish or bullish depending on the direction of the movement.

When examining a Pennant continuation pattern, the following is visible:

A flagpole: A Pennant pattern is usually preceded by a flagpole, which distinguishes it from other pattern kinds (such as the symmetrical triangle). The flagpole is the initial forceful movement before the formation of the symmetrical triangle.

There will be two breakouts, one at the end of the flagpole and one following the consolidation phase, at which point the rising or downward trend will resume.

The Pennant pattern itself: The Pennant pattern is generated when the market consolidates between the flagpole and the breakout. The Pennant is formed by two converging trendlines.

These qualities may be observed in relation to the Bullish Pennant Pattern in the chart below.

Bullish Pennants are candlestick patterns that form during strong uptrends. The Pennant is created by an ascending flagpole, a period of consolidation, and then the continuation of the uptrend following a breakout. Traders are awaiting a break above the Pennant in order to profit on the renewed bullish trend.

Bullish Pennants are the polar opposite of Bearish Pennants. Bearish Pennants are continuation patterns that form in the context of severe downtrends. They usually begin with a flagpole - a precipitous decline in price followed by a halt in the downward trend. This pause takes the form of a triangular shape called the Pennant. Then a breakout occurs, and the downward spiral resumes. Traders search for opportunities to enter short positions on a break below the pennant.

Pennant patterns are quite similar to triangle patterns, but there are several critical distinctions between them that must be recognized in order to trade either pattern profitably.

These are the key differences to note:

Prior to forming a Pennant pattern, a strong upward or downward movement like a flagpole must occur. Without a flagpole, it is a triangle, not a Pennant.

A pennant has a proclivity for forming a shallow retracement (typically less than 38 percent of the flagpole). A significant retracement indicates the presence of a triangle rather than a Pennant.

The continuance of an upward or downward trend is what defines a pennant.

A pennant is a short-term pattern that typically takes between one and three weeks to complete. Typically, a triangular pattern takes significantly longer to create.

When trading, the Bullish and Bearish Pennant patterns are identical; however, the Bullish Pennant pattern will have a long bias, and the Bearish Pennant pattern would have a short bias. The following example explains how to trade a Bullish Pennant in GBP/NZD.

Traders should try to enter the trade once a rapid, abrupt surge in price confirms the breakout. Following a significant price move, the pennant pattern suggests that there is a good chance of a breakout and continuation in the direction of the initial move.

The entry point is a candlestick close above the pennant. In this case, the break was rather large, increasing the chances of a prolonged upward movement.

A stop loss can be put near the low of the breakout candle, given the magnitude of the move, or under the pennant for more conservative traders to reduce downside risk. This often provides traders with an appropriate amount of protection.

Bear in mind that markets do not always behave predictably, which is why traders must constantly practice smart risk management. To account for this, you should always trade with capital that you are willing to lose.

To determine target levels, traders can measure the distance from the flagpole's base to the Pennant and then replicate this distance from the price break out that immediately followed the Pennant.

Mar 24, 2022 16:14

Mar 24, 2022 17:32