Skylar Shaw

Apr 07, 2022 11:11

Although it is frequently said that "past performance is no guarantee of future outcomes," in this update, I will examine nine distinct TA items to determine whether, as Mark Twain famously remarked, "History Doesn't Repeat Itself, But It Often Rhymes." Take a look at Figure 1.

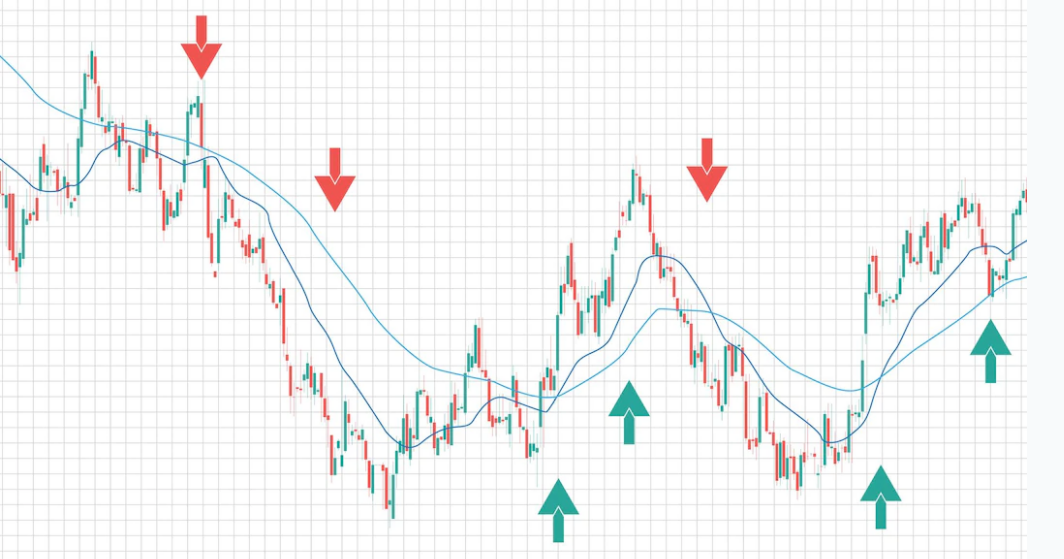

Figure 1: Daily candlestick charts of the S&P500 using a variety of technical indicators and moving averages.

The comparison to November 2021 shows that increased costs are on the way.

I compare the present rally to the one that began in October 2021 and lasted until December 2021, since the SPX has already risen about 500 points from the February 24 low. In the Tas, I've numbered the similarities between then and today. This approach enables objective evaluation of the price chart:

The Bollinger Bands expanded initially (black arrows), then the lower band bottomed, followed by a move back up, much like the index.

The index is above its 200-day simple moving average (in red) (SMA)

The Ichimoku Cloud is above the index.

The index is above the 50-day SMA.

The index is above the 20-day SMA.

The index dropped slightly before rallying.

The RSI5 dropped quickly, but did not go below 50.

The MACD fell slightly, and the histogram crested, but it was still solidly going upward.

MFI14 (Money Flow Indicator) remained around 70.

Since the notorious February 24 bottom, the S&P500 has rebounded almost 500 points. There are (at least) nine parallels between the most recent surge (October-December 2021) and presently, according to an impartial examination. The surge paused for a short while before adding 4.5 percent, followed by a more dramatic reversal (-5.3 percent).

The index experienced a brief pause in the middle of last week and has since resumed its upward trend. Similar to the surge in October and December of 21. Based on these nine comparable TA settings, the current rally has a good chance of reaching new uptrend highs (think SPX4750+/-50) before a more major pullback (think SPX4350+/-50).

Apr 07, 2022 10:38

Apr 07, 2022 11:35