Larissa Barlow

Mar 23, 2022 16:23

Numerous risks are inherent when investing in or trading in the equities markets. However, what increases your danger is your inability to spot or escape the numerous traps set up specifically to steal your money. The Bear Trap in Stocks is one such trap.

Markets rise as a result of an imbalance in the amount of purchasing and selling pressure. For instance, when there are a large number of buyers but no vendors willing to match them at the present price. In this case, buyers will increase their offers in order to entice sellers (the price they are willing to pay for the stock). The increased price is expected to attract additional suppliers to satisfy demand.

The issue is that whenever somebody purchases a stock, they instantly exert selling pressure on it. Bear in mind that once you buy a stock, you gain money from it only when you sell it (unless you earn dividends on the stock). Thus, if an excessive number of individuals purchase the stock, the purchasing pressure will decrease and the potential selling pressure would grow.

A Bear Trap is a device that is used to capture bears.

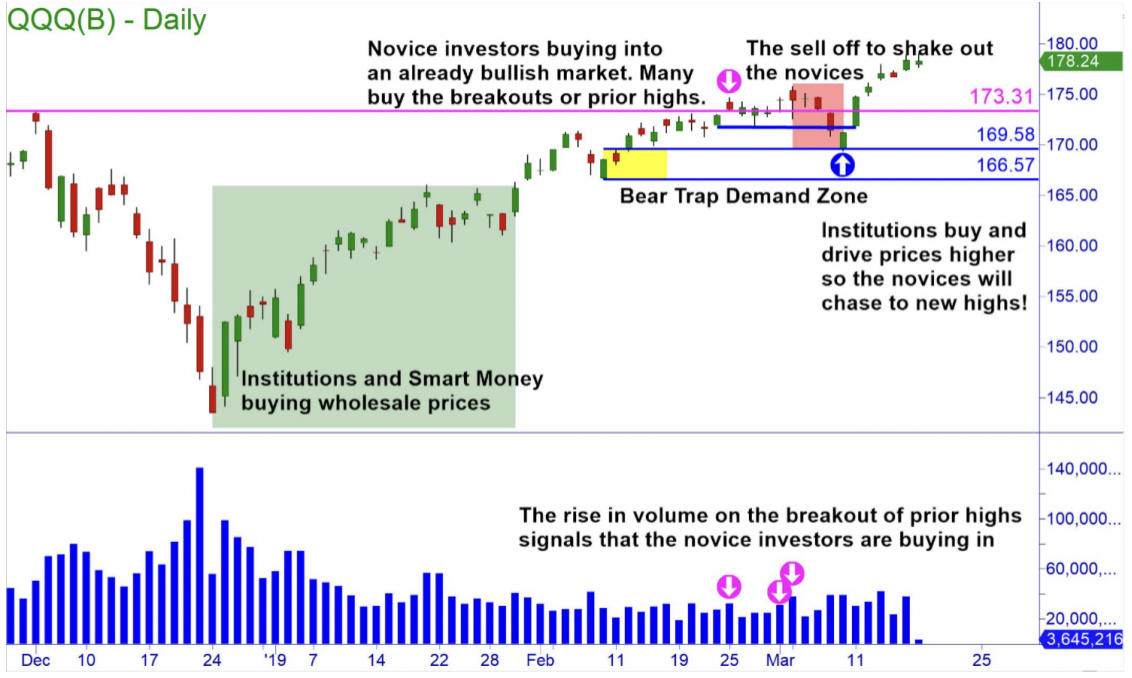

Institutions must weed out amateur/novice traders in order to increase demand and drive stock prices upward. They accomplish this by driving prices lower in order to create the illusion that the stock or market is turning pessimistic. Fear of losing their tiny earnings, or even of losing money in general, will drive novice investors to sell their stocks. Once a trader has been stopped out or duped into selling their stock, they commonly re-enter if they notice prices rising higher than the price at which they initially purchased it. This, in turn, increases demand and therefore prices, just as the institutions desired.

Institutions acquire stocks at wholesale prices, typically following a decline. This will result in the reversal of downtrends and the rising of markets. This is the optimal moment to purchase, yet many amateur and rookie investors and traders will wait until prices are already bullish before buying. Worse still, many people are encouraged to purchase breakouts and follow price upward. This indicates to institutions that the moment has come to put the bear trap on the stock. When a spike in volume occurs in conjunction with a price breakthrough, a bear trap is generally not long behind.

Intraday charts can potentially reveal bear traps on stocks. Typically, the same pattern is observed: prices breaking out to new highs, at which point institutions sell or short sell to amateurs purchasing the breakout. This effectively halts the upward momentum and sends beginners into a state of fear, leading them to sell their stock or activate their stop losses. Once the price falls below the level of demand, institutions buy to cover their short positions, driving prices higher, where amateurs rush back in fearful of missing out.

To benefit in the markets, you must trade professionally. Bear traps on stocks are often set in the same manner as mentioned previously. With an understanding of what pros look for when setting bear traps and how they trade them, you can trade and invest alongside the smart money.

If you adhere to OTA's Core Strategy, you will follow a set of guidelines and will trade and invest in accordance with the dominating trend and high-quality demand and supply zones. Additionally, there are Bull Traps that might provide a risk or an opportunity for traders. Visit your local Online Trading Academy Center now to learn more about the Core Strategy and/or additional market traps and opportunities.

Mar 23, 2022 16:10

Mar 23, 2022 17:03