Ralph Graves

Jan 04, 2022 09:53

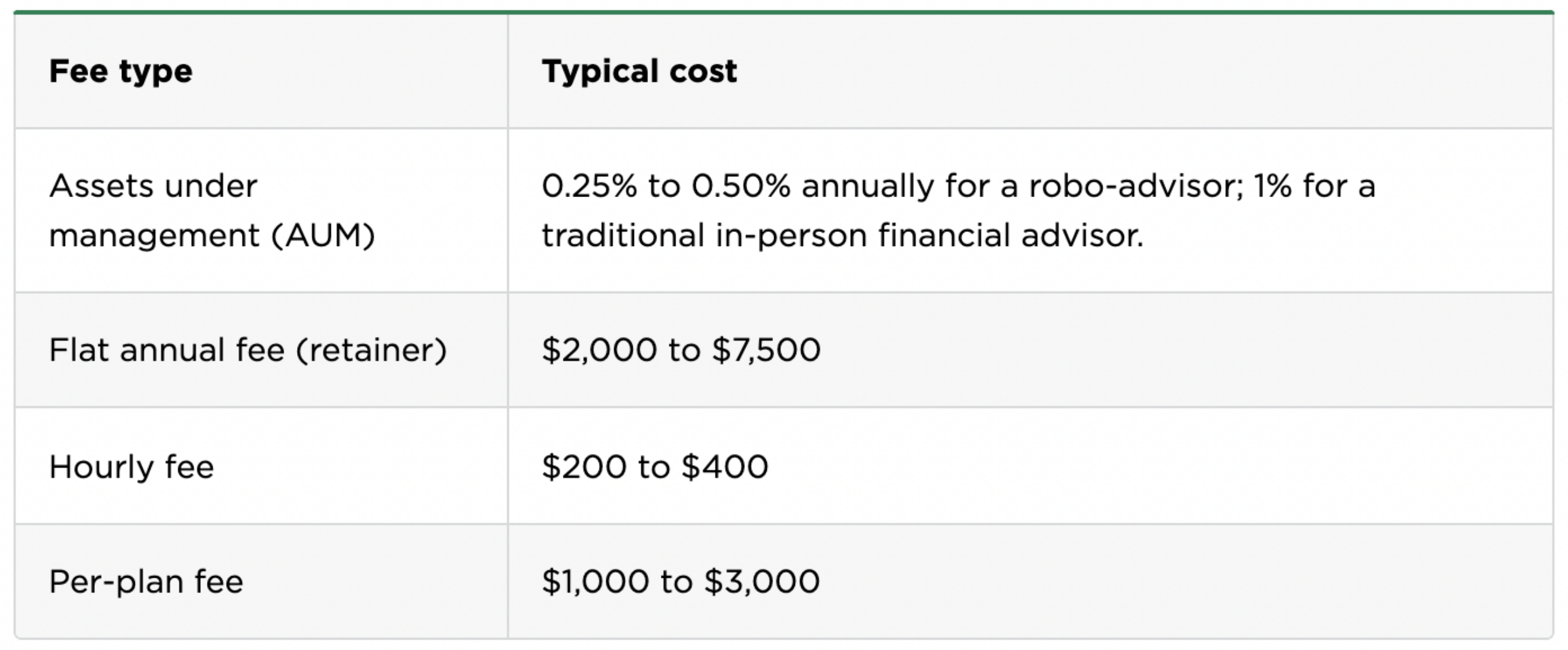

Many financial advisors charge based upon how much money they handle for you. That fee can range from 0.25% to 1% per year. Some financial advisors charge a level hourly or yearly fee rather.

What a financial advisor expenses depends upon the fee structure they make use of with their customers. Advisors that charge level fees can cost in between $2,000 as well as $7,500 a year, while the cost of advisors that bill a percent of a customer's account equilibrium-- commonly 0.25% to 1% annually-- will certainly differ based upon the dimension of that balance. For example, a client who spends $10,000 with a consultant that bills a 0.50% management fee will certainly pay $50 a year, while a customer who has actually $100,000 invested will pay $500.

Several advisors bill based upon just how much cash they manage for you, a fee framework called "possessions under management," or AUM. Some advisors charge a flat fee-- either per economic strategy, per year or per hour-- instead of an administration fee.

There are a number of varieties of financial advisors, including robo-advisors, on-line business as well as standard monetary coordinators.

We'll information them listed below, in addition to normal expenses, which will certainly differ dramatically based on the type of expert you pick.

Robo-advisors are computer-based services that assist you select as well as take care of investments. They're an excellent, low-cost fit if you're interested especially in investment administration-- a robo-advisor will develop and handle a financial investment portfolio for you based upon your goals, amount of time and threat resistance. Robo-advisors often require no or a low account minimum, so it's easy for novices to begin investing.

Cost: Robo-advisors normally bill an AUM fee of 0.25% to 0.50%, which exercises to $125 to $250 a year on a $50,000 account equilibrium.

What you get for that fee: Portfolios are constructed and also checked with computer algorithms. Robo-advisors generally don't offer customized monetary plans or individualized investment recommendations, yet lots of do supply online planning devices and also calculators.

These services operate online like robo-advisors however function even more like typical financial advisors They may use full-service, personalized monetary preparation alongside investment management. Unlike with a typical financial advisor, that planning is done basically, with phone or video clip conferences. Account minimums vary from no to a couple of hundred thousand bucks.

The method online financial planning services work varies. Some are robo-advisors with an added human element, supplying computer-managed portfolios and also accessibility to a group of financial advisors for planning guidance and guidance.

Others offer each client a dedicated certified financial organizer-- a credential that calls for considerable training-- that collaborates with you to build your investment portfolio as well as develop a total monetary plan. As a whole, online financial planning services cost less than a conventional in-person financial advisor.

Cost: Online planning services charge either an AUM fee-- in our study, it varies from 0.30% to 0.89%-- or a flat annual fee that starts at around $400 a year and also can go up to as much as numerous thousand bucks, depending on the level of economic suggestions you require. Keep in mind that some solutions could bill for financial investment management and also financial planning independently.

What you get for that fee: Investment management, a comprehensive monetary plan and also continuous access to economic planners for less than the cost of a conventional in-person consultant. Many solutions offer each customer a committed CFP. Meetings are held practically, by phone or video clip.

This is what lots of people think about when they think about a financial advisor-- a local service, where you most likely to meet with your consultant face to face in their workplace.

Standard human advisors utilize a range of fee structures. Right here are several of the most common, as well as what you normally get for that fee:

This coincides AUM design that robo-advisors as well as numerous online planning services use. Some typical advisors do not assume the fee they would gather on a small balance deserves their time and will not take on clients with less than $250,000.

Cost: The average AUM fee amongst human advisors has to do with 1% of possessions took care of each year, usually starting greater for little accounts as well as going down as your balance rises.

What you get for that fee: Investment management, and also sometimes, a comprehensive economic strategy and also guidance for exactly how to accomplish that plan. Nevertheless, some advisors who charge an AUM fee offer just investment management, not intending. You'll normally have a continuous partnership with the expert.

An established month-to-month or yearly fee. The cost normally isn't connected to how much you have available to invest, but you may pay more if your scenario is facility.

Cost: From $2,000 to $7,500 a year.

What you obtain for that fee: Typically, thorough planning as well as financial investment management: The expert will certainly produce a monetary strategy, assist you apply it, check your progression as well as readjust as required.

Some financial planners have actually an established hourly rate, which doesn't transform based upon your property level. You only spend for the moment you need.

Cost: $200 to $400 an hour.

What you obtain for that fee: You can arrange a couple of meetings to examine your retirement cost savings progression, prepare for the youngsters' college or get a practical budget plan. Or, if you want a full economic strategy, you can get that. You execute the plan on your own as well as there is no ongoing oversight from the supplier unless you demand and also pay for added time.

Some advisors bill a level fee for developing an economic strategy. There is no recurring management or oversight; you carry out the strategy yourself.

Cost: The cost will vary by service, but $1,000 to $3,000 is regular for a monetary strategy.

What you obtain for that fee: A comprehensive economic strategy and also guidance for how to follow it, yet no continuous services or financial investment monitoring. The advisor charges a set fee for each and every sort of service. You'll obtain a rundown of what's consisted of and also see the fee upfront.

Sometimes advisors are paid with compensations on the financial investments they advise (as well as those payments come out of your pocket).

Cost: Varies by investment, yet mutual fund sales loads typically drop in between 3% and 6% of your financial investment. This is a single fee paid at the acquisition or sale of the fund.

What you get for that fee: Typically, just investment administration. We usually recommend preventing commission-based financial advisors: While some certainly place your requirements initially, others may be swayed by the item that pays the highest possible commission. As well as the advisor may just be called for to advise investments that appropriate for you, but not always the very best fit.

Despite which kind of financial preparation service you choose, make sure to recognize specifically how much you'll pay for services and also what the services require. That's especially important with a typical human consultant because there are a lot of various settlement frameworks made use of.

A fee-only expert doesn't gain any payments from investments. These advisors face the fewest conflicts of interest when supplying recommendations. They might still assemble greater than one fee type-- for instance, billing an AUM fee for financial investment management as well as a level fee for economic planning.

A fee-based expert bills a fee however might additionally accept commissions from investments. Several advisors integrate compensations with an AUM fee.

A commission-only advisor makes their income from payments on the financial investments dealt on your behalf.

Sadly there is no "normal" fee that financial advisors typically charge. Due to the selection of fee frameworks and qualifications used by financial advisors, the wide range of services advisors offer and also geographical variations in pricing, it can be hard to understand just how much you need to pay for financial suggestions. As an example, a financial coach might supply less solutions than a CFP, yet they likely will not bill as much.

The varieties in pricing can really feel severe, yet bear in mind that you're just looking for what fits your needs. If you're after basic investment administration of a relatively small account, a level fee of $1,000 most likely way too much. On the other hand, if you have six figures to handle, dealing with the least expensive consultant you can discover might suggest you will not get the deepness of economic guidance you need.

Dec 31, 2021 17:49

Jan 04, 2022 17:39