Eden

Oct 25, 2021 14:08

Good for the second half of the year and only buy high-quality stocks

Huang Senwei, senior investment strategist at AllianceBernstein, told reporters that the global stock market is expected to show an upward trend in the second half of the year. There are opportunities for value and growth stocks, but we need to pay attention to selecting high-quality stocks.

Judging from the history of the United States over the past 100 years, it is still in the early stage of the bull market. After a relatively large bear market appears, there will be a bull market for many years to look forward to. Once the bull market begins, the US stock market will rise for an average of 5 years, with an average increase of about 250%. The shortest bull market has also risen for about 26 months. It has been almost 15 months since the new bull market at the end of March last year. From a historical point of view, we are still in the early or mid-stage of the bull market.

Esty Dwek, head of global market strategy at Natixis Investment Managers, an asset management company, also said, “Globally, vaccination is accelerating, major central banks are still extremely loose, financial support still exists, and corporate profits continue to recover. In such an environment, it’s hard to imagine There will be a very negative situation in the stock market."

Marija Veitmane, senior multi-asset strategist at State Street Global Markets, said: "We still believe that the success of vaccination and the reopening of the economy are key drivers of improved economic and earnings prospects and ultimately drive the stock market." Although there were concerns last month that the Federal Reserve will tighten policy faster than expected, in general, market participants expect that the central bank's policies will remain loose as a whole, thereby supporting the economy that has been hit hard by the epidemic.

Ben Lofthouse, head of global equity income at Janus Henderson Investors, said: "At present, global monetary and fiscal policies are still in a loose state. In fact, it will take some time before interest rates start to rise."

Goldman Sachs’s concern

Although most institutions are optimistic about the stock market in the second half of the year, there are still major banks that oppose it.

Goldman Sachs stated in a July 2 report that after the S&P 500 index rose about 15% in the first half of this year, investors should no longer expect the continued strong performance of US stocks in the next six months.

Goldman Sachs predicts that as expectations for interest rate hikes heat up, U.S. stocks may trade sideways in the next six months. Goldman Sachs expects US Treasury yields to climb to a cyclical high of 1.9% by the end of this year. Correspondingly, the expected surge in interest rates may put pressure on high-growth stocks and benefit cyclical stocks.

Goldman Sachs also recommends that investors pay attention to stocks with strong pricing power because of their high and stable gross margins. "In 2018-2019, due to accelerated wage growth and declining profit margins, stocks with high pricing power performed better than other stocks." Some well-known stocks in the Goldman Sachs high pricing power stock basket include Activision Blizzard, Etsy, Procter & Gamble and Adobe.

Looking ahead to the second half of the year, Goldman Sachs expects the S&P 500 Index to close at 4,300 points at the end of this year, basically the same as the closing points on June 30. But as the unemployment rate drops to 3.5%, Goldman Sachs expects the S&P 500 Index to rise by 7% to 4,600 points by the end of 2022.

For the market, there are two major risks that need to be vigilant in the second half of the year. The first is undoubtedly the Fed's policy shift. Some industry insiders worry that once the Fed starts discussing the slowing down of bond purchase plans in the second half of the year, the market may fall into turmoil as a result. The second risk is also related to the Fed. The current high inflation data may not be as fleeting as Fed officials expected, and rising prices may become a bigger problem for the US economy.

This year's stock market is similar to 2017

The performance of global stock markets in 2021 is very similar to the same period in 2017.

For the capital market, the similarities between 2021 and 2017 are evident in the first two factors. The trend of global economic recovery in 2017 is further strengthened by Trump's expectations of the implementation of the new tax cuts and deregulation of businesses and households, while financial conditions will continue to remain loose; and the most clear in 2021 is the loose financial conditions. It is the recovery of the global economy under the popularization of vaccines, superimposed on the implementation of Biden's fiscal stimulus New Deal.

Since the beginning of 2021, the top eight performances are China Concept Stocks, Petroleum, Hong Kong, Asia Pacific Ex-Japan, Emerging Markets, Japan, Indian Stocks, and Nasdaq. In the same period in 2017, China Concept Stocks, Hong Kong Stocks, and Nasdaq Hong Kong, Asia Pacific, except Japan, emerging market stocks, Nasdaq, gold, Indian stocks and S&P 500, have a high degree of overlap. This is not too surprising. In the context of the global economic recovery, the Greater China and Asia-Pacific stock markets usually lead other markets. It is worth mentioning that China Concept Stocks, Hong Kong, Emerging Markets, Asia Pacific Excluding Japanese Stocks, Nasdaq, Indian Stocks and S&P 500 maintained their advantages at the beginning of 2017 until the end of the year.

In 2017, the capital market set two important records under the excellent cooperation of the two indicators of economic activity and financial conditions.

First, according to Deutsche Bank's research, 99% of global tradable assets achieved a positive rate of return in 2017, which was the best year for the capital market since the data were recorded in 1901.

Second, the volatility of global stocks, bonds, commodities, and foreign exchange markets in 2017 has fallen sharply compared to 2016. Among them, the volatility of stock markets in the United States, Europe, Asia Pacific, and emerging markets, whether from actual volatility or panic index The expected future volatility to be measured, as well as the largest retracement of the broader market index during the year, both hit a record low in more than 30 years. In particular, the volatility associated with the S&P 500 hit a new low since the detailed daily data was available in 1926. From another perspective, the leading stock market in 2017 has basically continued to rise throughout the year, making investors who expect the market to fall and re-enter the market to find no time at all. The worst-performing asset in 2017, which continued to depreciate throughout the year, was the U.S. dollar, which is by no means a surprise. The U.S. dollar, which has counter-cyclical and risk-averse properties, usually depreciates during the global economic recovery phase because of the widening gap between the growth rate of other economies and the U.S., and appreciates when the global and U.S. economies perform poorly.

Since the beginning of 2021, the U.S. dollar has recovered somewhat, and its performance is different from the same period in 2017. However, after careful analysis of the reasons, it is not difficult to find that the short-term strength of the U.S. dollar is mainly due to technical factors, including the previous oversold and the weakening of the euro due to political factors. , U.S. stocks underperformed in January and so on. After these factors exit the market, the fundamentals of the US dollar will remain weak, and it will be difficult to improve at least in the first half of this year.

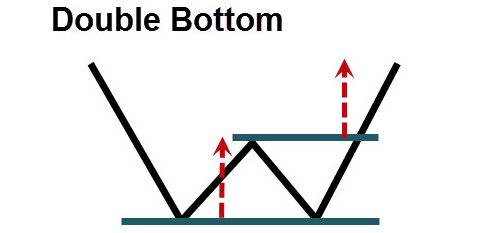

Using our analytical framework, we can see that the performance of the V-shaped reversal of global stock markets in 2020 is also closely related to the changes in the trend of economic activity and financial conditions. The bolder and more keen investors will find that the development process of global stock markets in 2020 and 2016 is very similar.

Oct 25, 2021 14:08

Oct 25, 2021 14:08