Cory Russell

Apr 06, 2022 12:03

Shortly after the cash market closed on Monday, June E-mini Dow Jones Industrial Average futures were trading higher. Despite the fact that the blue chip index is up for the day, it is trailing the benchmark S&P 500 Index and the technology-driven NASDAQ Composite.

June E-mini Dow Jones Industrial Average futures are trading at 34826, up 108 points or 0.31 percent, at 20:19 GMT. The SPDR Dow Jones Industrial Average ETF (DIA) closed at $349.18, up $1.17 or 0.34 percent from its previous close.

The S&P 500 Index and the NASDAQ Composite both rose for the day, but the S&P 500 Index and the NASDAQ Composite jumped out in front due to their large exposure to technology firms. Tech stocks, which had been battered in the first quarter due to expectations of interest rate hikes, rallied the most, topped by a 27 percent increase in Twitter shares.

Apple Inc, Intel Corp, and Microsoft Corp, which were up 2.37 percent, 2.27 percent, and 1.79 percent, respectively, led the Dow higher.

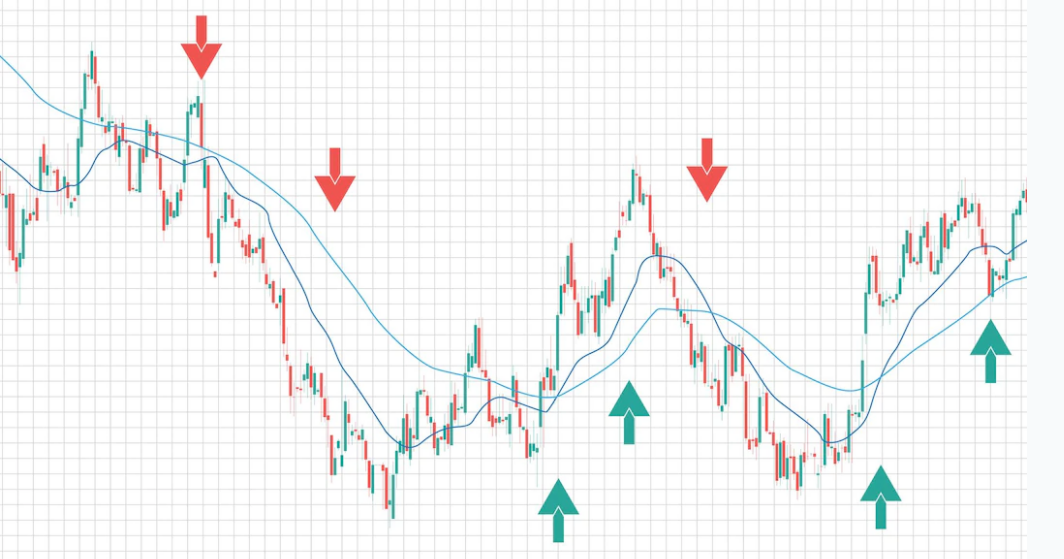

According to the daily swing chart, the overall trend is up, although momentum is falling. The return of the uptrend will be signaled by a trade through 35281. The major trend will shift to the downside if the price breaks through 34214.

36708 to 32086 is the primary range. At 34397 to 34942, the E-mini Dow is now trading within its retracement zone.

This zone is in charge of the average's near-term direction.

35649 to 32086 is the middle range. Another probable support region is the retracement zone, which runs from 34288 to 33868.

The two retracement zones are combined to form a significant support cluster region between 34397 and 34288. Since March 17, this zone has been supporting the market.

Trader reaction to 34859 is expected to decide the direction of the June E-mini Dow Jones Industrial Average into Monday's closing.

The presence of buyers will be shown by a prolonged advance over 34859. This may result in a short test of the primary Fibonacci level at 34942.

Surpassing 34942 will signal that the purchasing is becoming more active. This might result in a surge to the major high at 35281.

The presence of selling will be signaled by a persistent rise below 34859. Look for a retest of the minor bottom at 34437, followed by the support cluster at 34397 to 34288, if this provides enough negative momentum.

Check out our economic calendar for a complete list of today's economic happenings.

Apr 06, 2022 11:57

Apr 07, 2022 10:38