Saqib Iqbal

Dec 16, 2021 16:47

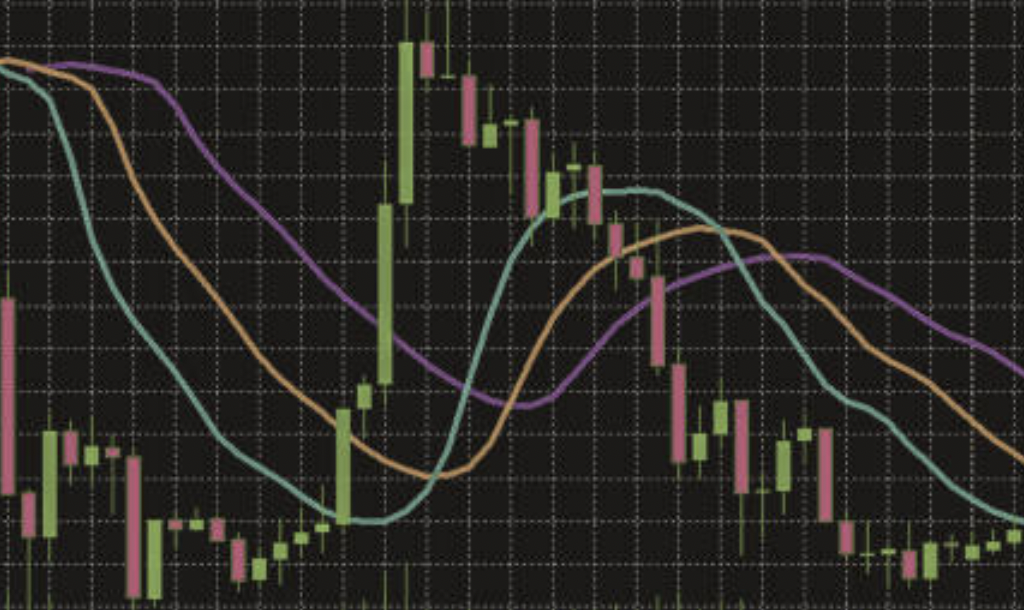

When you put a trade, you are either 'buying' or 'selling' a financial instrument. There are purchasers and sellers in every market. Here we talk about how their relationship works, and how it influences the markets.

When you open a 'buy' position, you are essentially buying a property from the marketplace And when you close your position, you 'sell' it back to the marketplace. Buyers-- likewise known as bulls-- believe an asset's value is most likely to increase. Sellers-- or bears-- generally believe its worth is set to fall.

When you open a position with a broker or trading company, you'll exist with two costs. If you want to trade at the buy cost, which is slightly above the market price, you open a 'long' position. If you wish to trade at the sell price-- a little listed below the marketplace rate-- you open a 'brief' position. The distinction in between the buy and sell price is called the 'spread', which the service provider takes to help with the position.

A long position in conventional trading is when you buy a property in the expectation its rate will increase, so you can sell it later for an earnings. This is also referred to as going long or buying.

Making a long trade doesn't necessarily suggest buying a physical property. Derivatives like CFDs and futures contracts provide you the opportunity to take a long position on a market without owning underlying possession. You are simply speculating that the price of the possession will rise.

A short position in trading is a strategy utilized to take advantage of markets that are falling in price. When you make a brief trade, you are selling an obtained possession in the hope that its price will decrease, and you can buy it back later on for a profit. It is also known as short-selling, shorting or going short.

Short-selling works by borrowing the hidden property from a trading broker, and then immediately selling it at the present market value. Shorting is the opposite of going long-- where you will earn a profit if the price goes up.

Again, let's state you wish to trade bitcoin against the United States dollar (bitcoin/USD). The existing market price is 3919, and you choose to take a short position and sell 5 contracts (each equivalent to 1 BTC) to open a position at this cost.

If you were right, and the worth of bitcoin fell versus the United States dollar, your trade would benefit. Let's state that the brand-new market price is 3874, you might close your position and take your profit by buying 5 contacts to close your position at the buy cost of 3879, which is somewhat higher than the marketplace rate due to the spread. Due to the fact that the marketplace has actually moved 40 points in your favour, the earnings on your trade would be calculated as follows: 5 x 40 = $200. If the marketplace moved against you by 40 points, you would have made a loss, calculated as 5 x -40 = -$ 200.

If you want to take a long or short position on a market, you can open a CFD trading account. CFD trading is the buying (going long) and selling (going short) of contracts for the difference in rate of a property, between the opening and closing of your position.

CFDs and are derivative items, due to the fact that they allow you to hypothesize on monetary markets such as shares, forex, indices and products without needing to take ownership of the underlying possessions. Both approaches utilize leverage, which indicates you just have to put up a little margin (deposit) to get direct exposure to the full worth of the trade. This can amplify your prospective revenue, but also your possible loss.

Purchasers and sellers impact supply and demand-- and therefore the cost-- of a possession. At any given time, one group tends to exceed the other, which's the main reason the price of a market varies. When the buyers exceed the sellers, need for the market increases. As a result, the rate of the property rises. When it's the other way around, supply boosts and need for the possession starts to drop-- and the cost falls. The way supply and demand impact markets is often described as volatility.

A buyer's market is when buyers have the advantage over sellers. They can work out a better buying rate for an asset due to the fact that supply is far more than need. A seller's market is when there is restricted supply of an asset and an overflow of buyers. In this case, the seller has the advantage.

We've summed up a few bottom lines to remember on buying and selling below.

When you put a trade, you are either 'buying' or 'selling' a monetary instrument

A long position in trading is when you buy a property in the expectation its cost will increase

A short position in trading is when you sell a possession in the expectation its rate will fall

You can go long or short on a market by opening a CFD account

When buyers surpass sellers, demand boosts, and price increases

When sellers surpass purchasers, supply boosts, and need and rate drop

Dec 16, 2021 15:13

Dec 16, 2021 17:18