Summary

Award-winning proprietary trading platform alongside MT4.

This broker does not provide unique features of any significance. What it does do, however, is focus well on its core trading environment; in that respect, it exceeds that which is currently offered by many of its competitors. For example, warranting a notable mention, Capital.com TV is filled with excellent videos that cover a wide range of trading-related content. It presents an outstanding auxiliary trading service and offers clients an informative break from regular day-to-day operations. Many brokers offer video services, but this one is certainly a good one. Additionally, it provides trading ideas related to current events. Capital.com TV is a comprehensive service for traders to consider, even if they are not clients of this brokerage.

Capital.com TV is an outstanding auxiliary service maintained by this broker.

Fund is currently at a high risk.

Fund is currently at a high risk.

Fund is currently at a high risk.

Oct 11, 2021 19:16

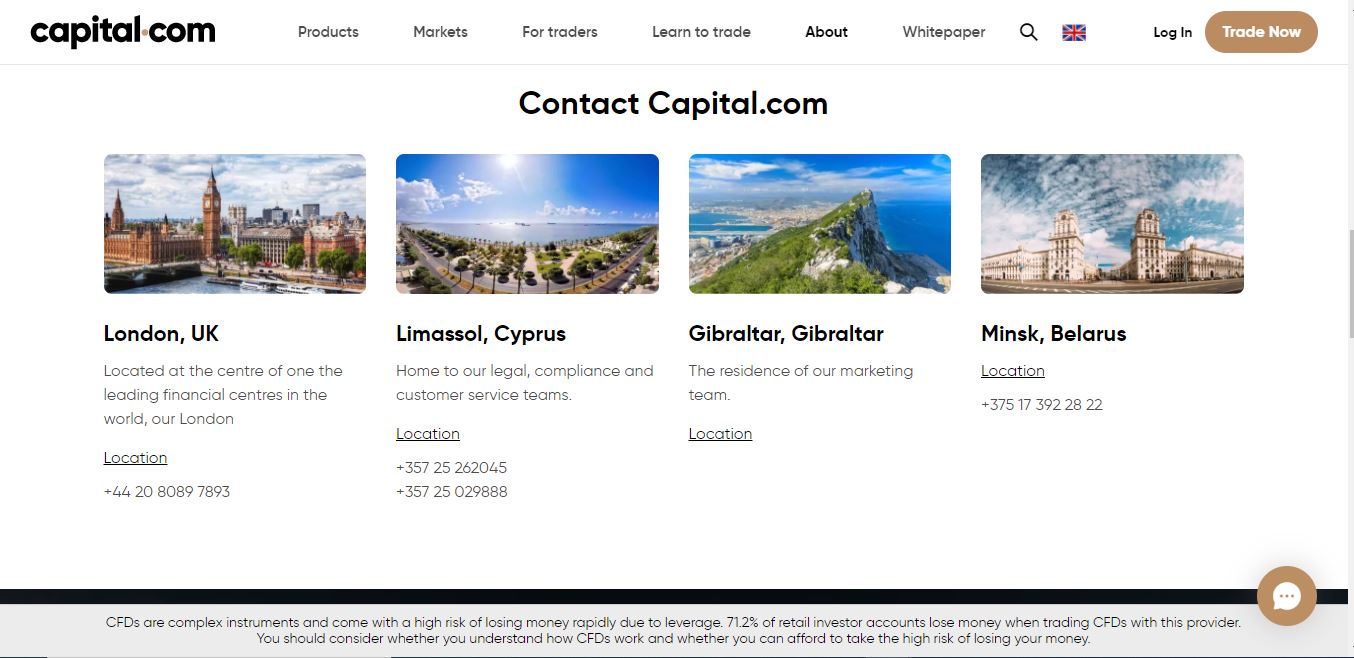

Capital.com is an international CFD brokerage operating out of subsidiaries located in the UK, Cyprus, and Belarus. It is home to over 2 million traders and has processed over $18 billion in volume. Over 3,000 of the most liquid assets across five sectors provide an attractive option for all types of traders to consider. Client funds remain fully segregated at RBS and Raiffeisen, two of Europe’s largest financial institutions, and accounting heavyweight Deloitte audits accounts. This broker also caters to institutional clients, through its Prime Capital division, suggesting a deep liquidity pool. The broker presents only a proprietary trading platform. New traders have access to Investmate, the educational platform of Capital.com. A secure and transparent trading environment adds to the benefits of this broker, where 71.2% of traders operate their portfolios at a loss,well below the industry average.

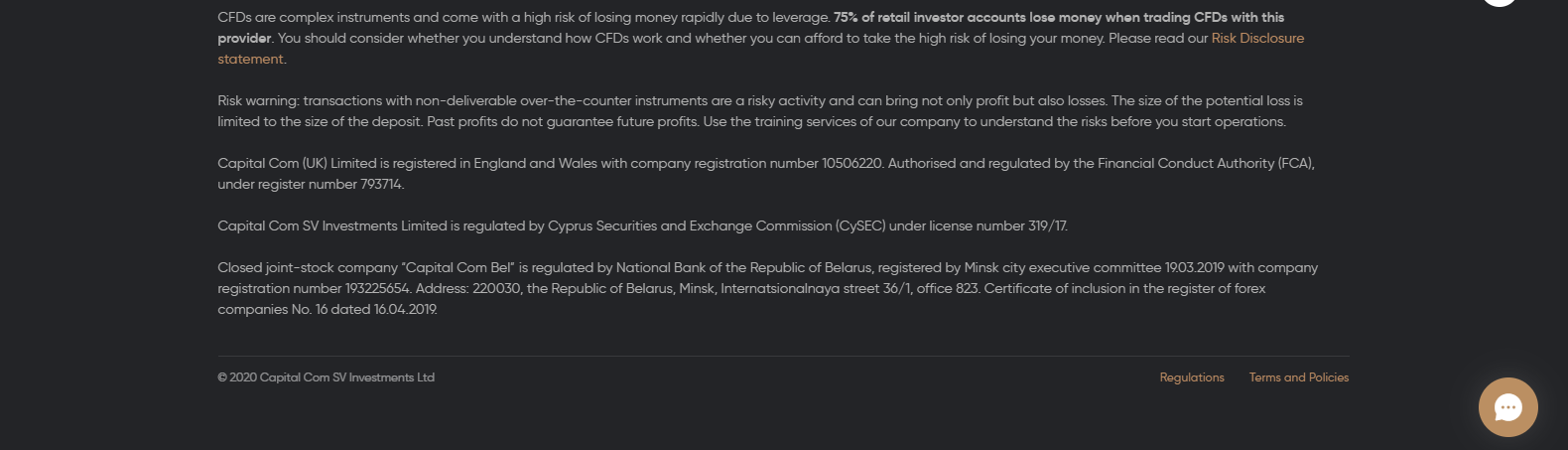

Capital.com (UK) Limited registered with the Financial Conduct Authority (FCA) in September 2017 and began trading in April 2018. Capital Com Investments Ltd has operated under the Cyprus Securities and Exchange Commission (CySEC) regulatory framework since September 2017. Capital Com Bel CJSC, a closed joint-stock company, is authorized by the National Bank of the Republic of Belarus, where the Minsk City Executive Committee issued a license in September 2019. The company was included in the register of Forex companies the following month.

Portfolios of traders at the UK subsidiary are protected by the Financial Services Compensation Scheme (FSCS), up to £85,000. EU Directive 2014/49/EU protects CySEC managed accounts under the Investor Compensation Fund (CIF) with maximum coverage of €20,000. The Financial Instruments Directive 2014/65/EU or MiFID II, and the EU’s 5th Anti-Money Laundering Directive, also apply to the EU regulated brokerage.

All client deposits remain fully segregated from company funds at well-established European financial firms, namely RBS in the UK and Raiffeisen Bank in Austria. Deloitte, one of the most well-known and respected financial auditors in operation today, audits the accounts of Capital.com. All transactions adhere to the PCI Data Security Standards. Necessary documents, including Pillar 3 disclosures and Key Information Documents (KID), are published on the website. From that, one is able to determine that Capital.com is a well-regulated and transparent brokerage, maintaining a secure trading environment for all clients.

Three regulatory jurisdictions ensure a secure trading environment.

Capital.com derives its revenue from spreads across 3,000 assets, while no commissions apply. The EUR/USD is listed as low as 0.6 pips, representing a competitive offer with no additional costs. Swap rates on leveraged overnight positions apply, however Capital.com charges only for the amount borrowed and not the total position size. With no other fees noted, the pricing environment is one of the most trader-friendly in today’s brokerage industry, favoring client profitability over company revenue generation. Capital.com sets a positive example with its low-cost trading environment, which is ideal for all types of strategies, including high-frequency traders and institutional clients.

Capital.com maintains one of the most trader-friendly pricing environments available.

All deposit and withdrawal fees are covered, while swap rates are remarkably competitive.

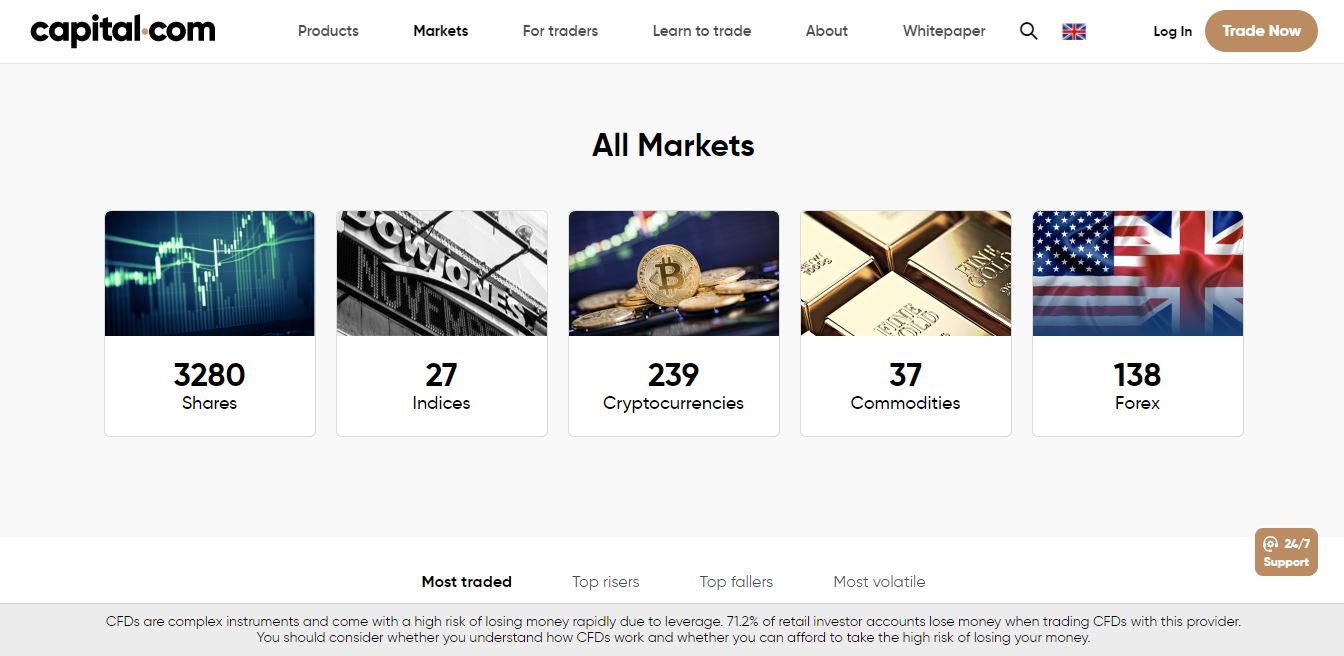

Traders have access to an outstanding asset choice, spanning over 3,000 names across five sectors. Pure Forex traders will find the 138 currency pairs one of the most comprehensive selections available, making Capital.com a premier choice for this sector. Traders have excellent exposure to this emerging sector with 238 cryptocurrency pairs, including crypto-crypto crosses, as well as exotic pricing in the Mexican Peso, Belarusian Ruble, Hungarian Forint, or Thai Bhat, to name just a few. Adding cross-asset diversification opportunities are 40 commodity and futures contracts, complementing the broad currency selection. More than 2,800 equity CFDs from 13 countries grant access to the most liquid names, while 28 index CFDs complete the asset selection.

Traders will discover that Capital.com provides one of the most comprehensive asset lists available, including 135 currency pairs.

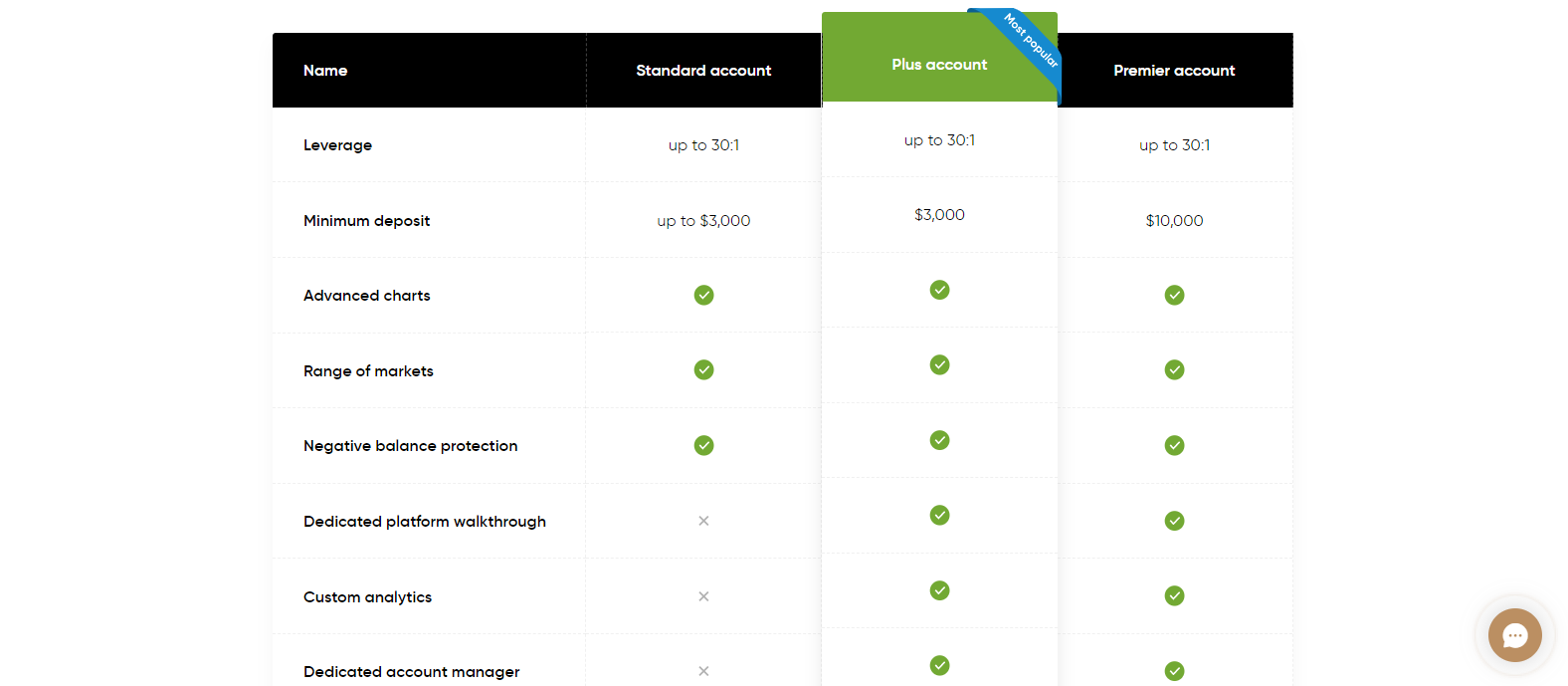

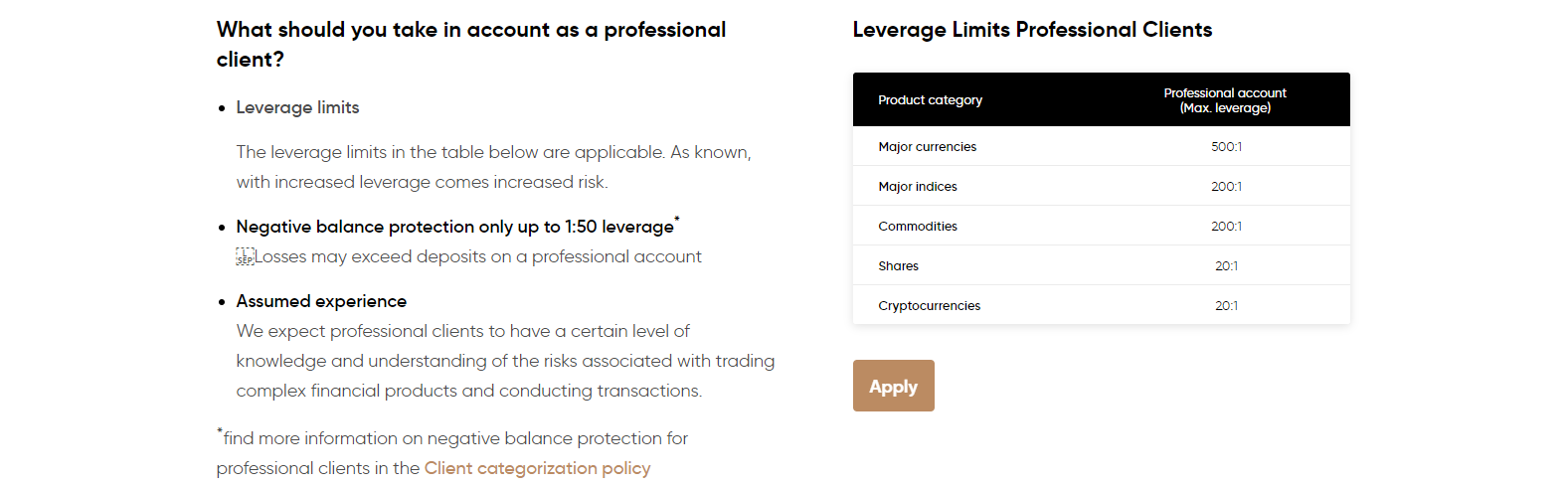

Three CFD accounts are listed, but core trading services are essentially the same. The most notable difference is for accounts above $3,000 (i.e, Plus and Premier accounts) with the inclusion of custom analytics; however, given that traders with more significant portfolio sizes generally execute their own strategies, the added service is rendered irrelevant. A minimum deposit of $20 applies, and the maximum leverage for retail traders, as stipulated by EU regulations, is 1:30. The Belarusian subsidiary provides traders with a more generous 1:100 trading environment. A professional account, which features leverage up to 1:500, is also available if requirements are met. It is important to note that the professional account is without negative balance protection if leverage above 1:50 is deployed. Institutional clients are served by the broker's Prime Capital division.

What should you take into account as a professional client?

-As known, with increased leverage comes increased risk.

-Negative balance protection only up to 1:50 leverage

-Losses may exceed deposits on a professional account

-Capital.com expects professional clients to have a certain level of knowledge and understanding of the risks associated with trading complex financial products and conducting transactions.

-Professional clients are not covered by the ICF/FSCS.

Core trading services across three CFD accounts are identical.

A professional account upgrade is possible for qualifying traders.

Prime Capital is the division which caters to institutional clients.

Capital.com invested in a proprietary trading platform. According to the website, artificial intelligence is integrated, but cannot be confirmed. Presumably, it is operated by the most basic machine learning protocols, as evident by the information provided on the website. It is remarkably user-friendly, equipped with an extensive charting package, and ideal for manual analysis. The popular MT4 trading platform is offered as an alternative, supporting automated trading solutions.

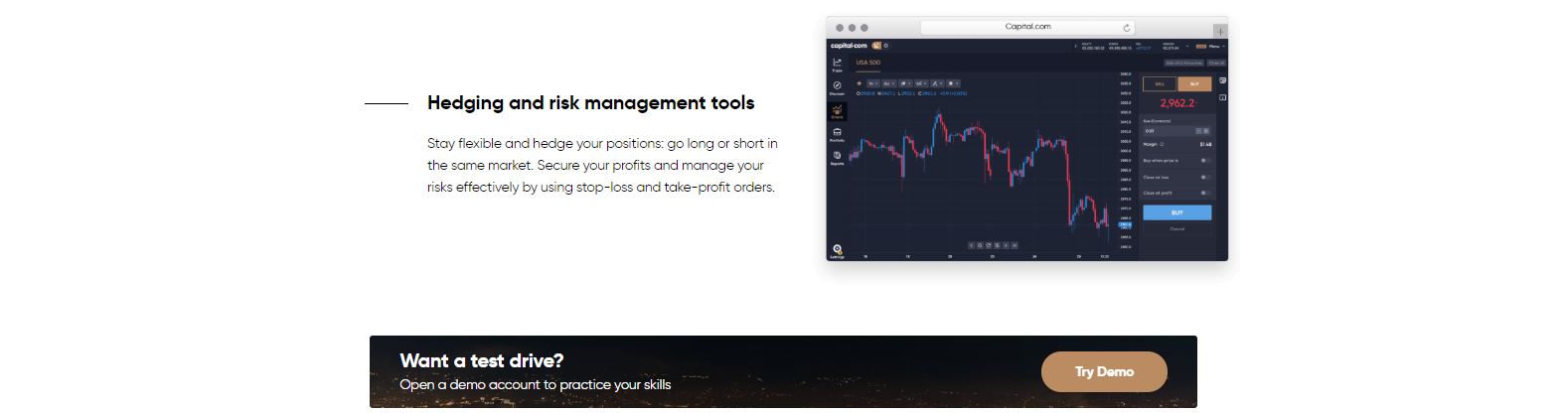

Having said that, the available proprietary platform offers a reliable portal for manual traders to analyze assets, with over 70 technical indicators and extensive drawing instruments. An in-depth analysis is entirely possible with the enhancement of fundamental reports. Multi-chart toggling allows up to six tabs to be used, while personalized watchlists enable traders to manage multiple portfolios with ease. Hedging and risk management tools are at the core of the platform, allowing for the complexity of strategies and security of deployed capital. With a modern look, this easy-to-use platform is ideal for manual traders.

Artificial intelligence is a popular advertising tool, but the in-house proprietary trading platform lacks this function. A combination of scripts and basic machine learning protocols are more likely.

Proper tools for in-depth manual analytics are available.

Multi-chart toggling and personalized watchlists enhance the manual analysis process.

Hedging and risk management tools add a layer of complexity and security.

This broker does not provide unique features of any significance. What it does do, however, is focus well on its core trading environment; in that respect, it exceeds that which is currently offered by many of its competitors. For example, warranting a notable mention, Capital.com TV is filled with excellent videos that cover a wide range of trading-related content. It presents an outstanding auxiliary trading service and offers clients an informative break from regular day-to-day operations. Many brokers offer video services, but this one is certainly a good one. Additionally, it provides trading ideas related to current events. Capital.com TV is a comprehensive service for traders to consider, even if they are not clients of this brokerage.

Capital.com TV is an outstanding auxiliary service maintained by this broker.

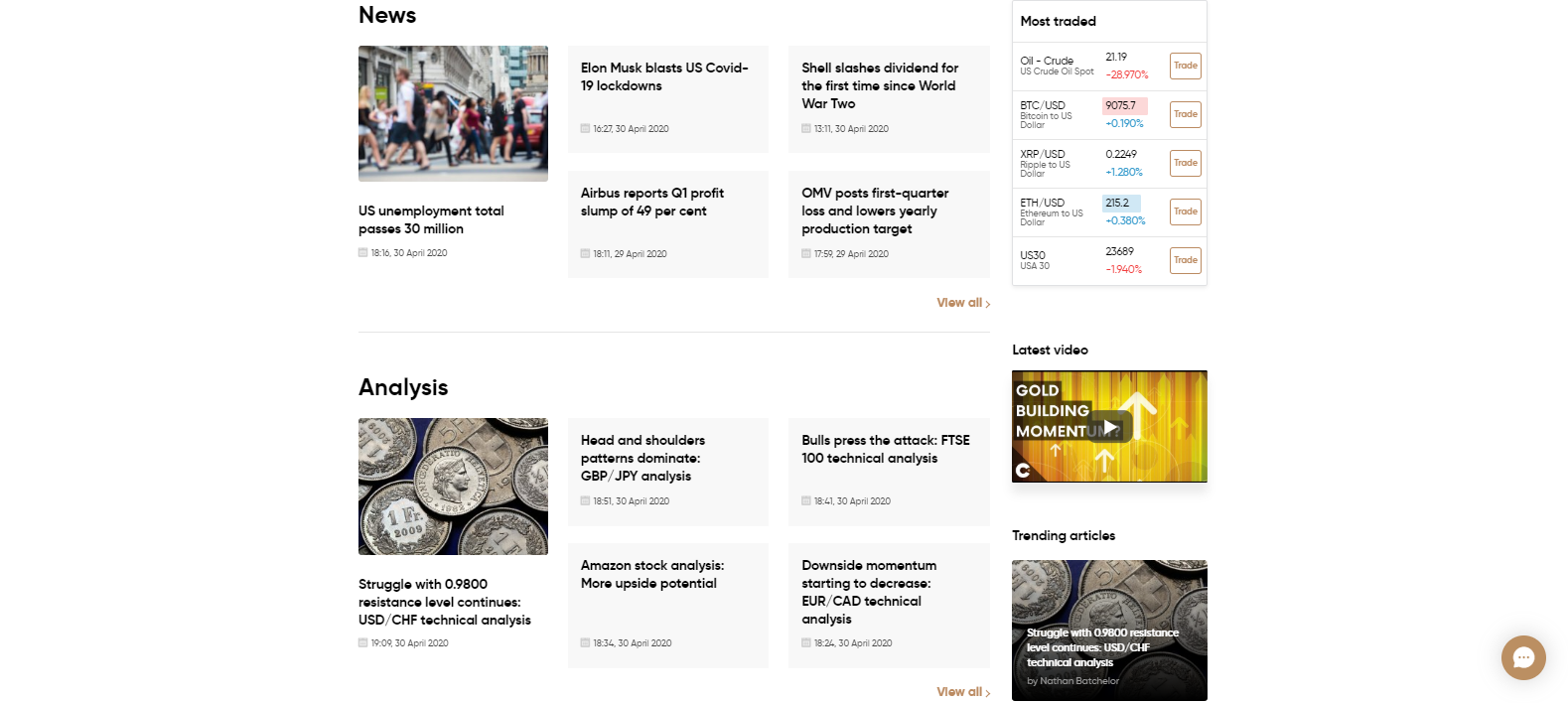

Chief Market Strategist David Jones leads the in-house research team. The Financial News and Features section is filled with well-presented written analytics and fundamental news, complementing the trading ideas discussed on Capital.com TV. Traders in the Plus or Premier account will also receive custom research, though no additional information on that offering is provided. It remains unclear which criteria influence customization or how qualifying traders receive this service.

Besides news and analysis, the “Features” sub-category enhances the overall value and provides new traders with fresh ideas. The overall quality of content, comprehensive analysis, and educational value within the research sector combines for a dependable trading service for clients and non-clients alike. It adds to the overall appeal of Capital.com and distinguishes it from a large number of competitors.

Manual traders have access to fundamental news and technical analysis, generated in-house by Capital.com.

The Features category presents new traders with fresh ideas.

Investmate is at the core of education provided by Capital.com. It features six goals for new traders to select, followed by six distinct paths to reach them. New traders can explore various approaches to trading and determine the most suitable one. Over thirty short courses of less than three minutes each are included. The principle goal of Investmate is to make what is often deemed complicated as straightforward as possible. It is exclusively available for mobile phones.

Five courses are available on the website, creating an in-depth introduction to the most fundamental elements of trading. Each is divided into multiple lessons and completed with a quiz to ensure new traders acquired the necessary knowledge. Numerous educational articles, including seven guides, are equally available. The glossary provides a comprehensive list of terminology.

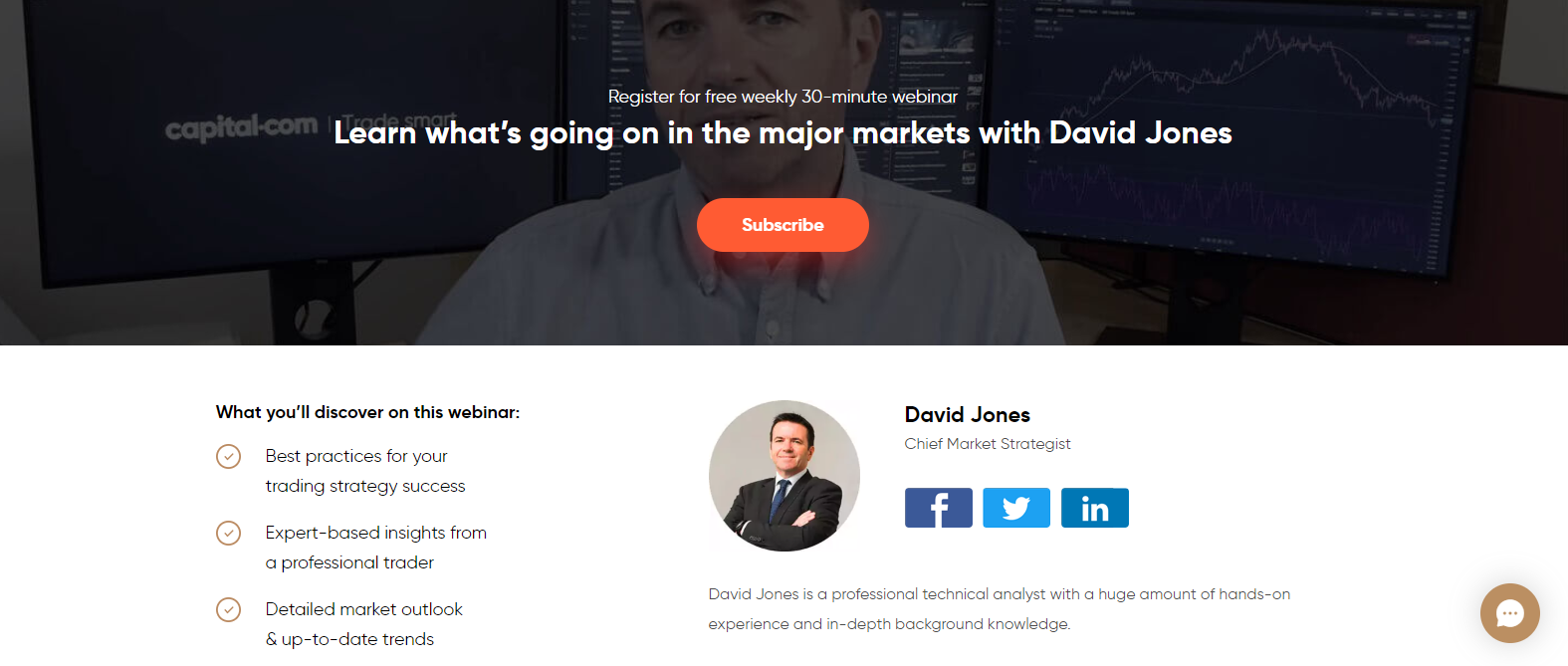

Free 30-minutes webinars, which are hosted by Chief Market Strategist David Jones, are available to subscribers of this broker's official YouTube channel. Interested traders can join over 55,000 subscribers for informative market-related topics. The newest videos may be viewed directly on the website.

Investmate offers a comprehensive educational course on mobile devices.

Five courses, divided into multiple lessons, allow traders to acquire the necessary knowledge to start their trading careers.

A quiz at the end of each course completes it.

Chief Market Strategist David Jones also hosts free weekly webinars.

Clients may access customer support, located in Cyprus 24/7, via the webform, by phone call to one of the eight provided phone numbers, or via the live chat function. The FAQ section generally provides answers to the most common questions. Capital.com is a well-operated brokerage where assistance is rarely required but easily obtained, if needed.

Accounts opened under the Belarus branch, following a deposit and one complete trade within 30 days, are eligible to enter trading competitions and for a one-off $50 sign-up bonus, subject to detailed terms and conditions.

The account opening process is remarkably quick and merely requires an e-mail address and username to receive access to the back office of Capital.com. New traders are required to verify their accounts, as mandated by regulators, to comply with AML/KYC requirements. A copy of the trader’s ID and one proof of residency document usually completes this process. Capital.com is a regulated, transparent broker, and traders may trust it with their personal information as well as capital.

A username and password complete the account opening process, but verification is mandatory as required by regulators.

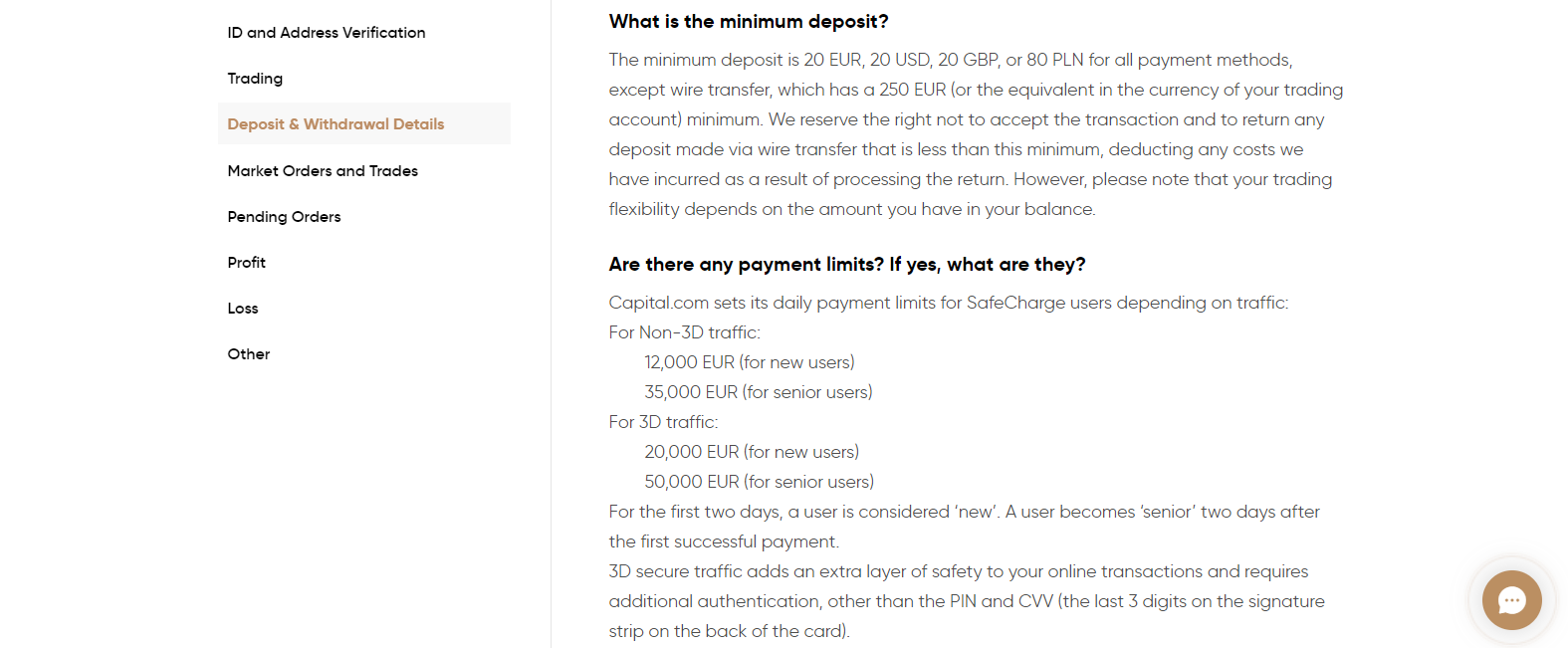

Deposit and withdrawal options include bank wires, debit/credit cards, Applepay, Sofort, Ideal, Giropay, Multibanco, Prezelewy, Qiwi, Webmoney, and Trustly. The minimum deposit is $20 or a currency equivalent for all methods. Bank wires require no less than $250. Payment limits are in place, but they are sufficient to cover the majority of retail and professional traders. Processing times are dependent on the payment provider. Capital.com notes 24 hours for credit/debit card withdrawals, with near-instant execution for online solutions. Per regulatory stipulations, the name on the payment processor and trading account must be identical. The overall choice is vast and allows traders flexibility in money management.

Capital.com supports a broad range of payment options.

Daily payment limits are in place, but they are sufficient for the majority of traders.

Broker's Name : Capital.com

Headquarters : Cyprus

Regulation :

Type of Broker : Market Maker

U.S. Clients Allowed :

Minimum Deposit : $20 or a currency equivalent

Maximum Leverage : 1:30 retail, 1:500 professional

Commissions / Spreads : Spread

Account 1 : Standard

Account 2 : Plus

Account 3 : Premier

Account 4 : Professional

Demo Account :

Islamic Account :

Segregated Account :

Managed Accounts :

Institutional Accounts :

Deposit Options :

Withdrawal Options :

ETFs :

CFDs :

Commodities :

Metals :

Stocks :

Oil :

Gold :

Binary Options :

Indices :

Type of Platform : MetaTrader 4, Proprietary platform, Web-based

![]() English

English

![]() Swedish

Swedish

![]() Thai

Thai

![]() Malay

Malay

![]() Russian

Russian

![]() Chinese

Chinese

![]() German

German

![]() Italian

Italian

![]() Spanish

Spanish

Other

Platform Languages :

Mac

Mac

Windows

Windows

Linux

Linux

Mobile

Web

iPhone

iPhone

iPad

iPad

OS Compatibility :

Trading Signals :

Charting Package :

Market Analysis :

Chart Trading :

Automated Trading :

Scalping :

Hedging :

Mobile Alerts :

E-mail Alerts :

Trailing Stops :

Guaranteed Stop Loss :

Guaranteed Execution :

One-click Execution :

OCO Orders :

Interest on Margin :

Web-based Trading :

Mobile Trading :

![]() English

English

![]() Hungarian

Hungarian

![]() Polish

Polish

![]() Swedish

Swedish

![]() Bahasa

Bahasa

![]() Thai

Thai

Portuguese

![]() Russian

Russian

![]() Chinese

Chinese

![]() German

German

![]() French

French

![]() Italian

Italian

![]() Spanish

Spanish

Other

Website Languages :

Support Hours : 24/7

E-mail Support :

SMS Support :

Chat :

Excellent Forex and cryptocurrency selection

A competitive commission-free pricing environment

Award-winning proprietary trading platform alongside MT4

High-quality educational section built around Investmate

Disadvantages

Leverage for FCA/CySEC clients restricted to 1:30

We have gathered a list of the top broker alternatives to Capital.com, and conducted an in-depth broker comparison to assist you in choosing the right broker for your trading needs.

Clients of Capital.com operate in a well-regulated and secure trading environment. The broker is fully compliant with two regulators and operates in a wholly transparent manner. In its relatively brief history, Capital.com has established itself as a reliable brokerage.

Traders can either download the mobile application or use the webtrader. Both feature the proprietary trading platform provided by Capital.com.

The comprehensive educational section makes it a sound choice for inexperienced traders.

Only CFDs are maintained at Capital.com, intended for trading purposes, and not suitable for investors.

Capital.com is a relatively young broker, in operation only since 2017, but it has already attracted over 360,000 clients. That is primarily due to an excellent asset selection, where pure Forex traders have 135 currency pairs to analyze, in combination with an extremely competitive pricing environment that is free of commissions for attractive spreads across over 3,000 assets. This broker grants a secure trading environment. It is refreshingly transparent and genuinely honest about the products and services provided.

New traders have access to an outstanding educational suite, while the in-house research team generates fresh trading ideas daily.Capital.com maintains the popular MT4 trading platform, in addition to its proprietary platform.

The proprietary platform lacks support for automated trading solutions. Manual traders, however, will find the trading platform an excellent portal for analytics, and portfolio management. The platform is also suitable for smaller asset management firms, serviced by the broker’s Prime Capital division. Capital.com TV represents a well-executed hidden gem for all traders to consider, even if they are not interested in becoming a client. Capital.com, given the low-cost structure and generous asset selection, deserves serious consideration by committed traders and should be included in a well-diversified broker selection.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67.7% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.