Summary

Highly regulated, choice of fixed or floating spreads.

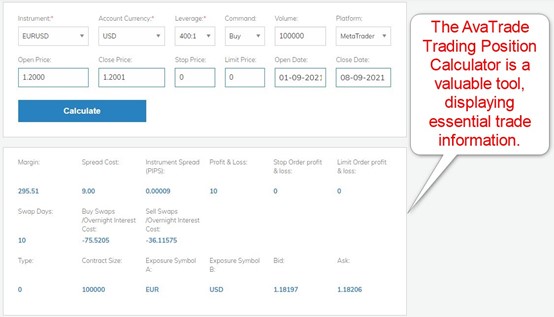

Besides services by Trading Central, ideal for beginner traders and those unable to conduct broad-based market analytics, I like the Trading Position Calculator AvaTrade maintains on its website. It presents an excellent risk management tool, provides vital trading information, and allows traders to plan and maintain their portfolios.

Another fact I want to note is the superb transparency at AvaTrade, which ensures all necessary information for each trading instrument is publicly available on its website.

Fund is currently at a high risk.

Fund is currently at a high risk.

Fund is currently at a high risk.

Oct 11, 2021 17:57

Irish-headquartered AvaTrade grew into one of the most trusted and well-known brokers. The success of its educational division, SharpTrader, drove growth and resulted in a spin-out. AvaTrade focuses on growing its market share behind an excellent choice of trading platforms and a wide choice of assets. I reviewed AvaTrade to determine if its advertised next generation of trading tools provide traders with a competitive edge. Does AvaTrade deserve your deposits?

Pros | Cons |

High-quality educational offering via SharpTrader | Trading costs competitive but nothing special |

Excellent choice of trading platforms catering to various trading needs | |

Broad asset selection and cross-asset diversification opportunities | |

Well-regulated and trusted broker with oversight from a central bank |

| 🗺️ Headquarter | Ireland |

| ⚖️ Regulations | Central Bank of Ireland, BVI, FSCA, ASIC, ADGM-FSRA, FSA/FFAJ, ISA |

| 💰 Established | 2007 |

| 💰 Minimum Deposit | $100 |

| 💰 Maximum Retail Leverage | 1:400 |

| 📊 Execution Type | Market Maker |

| 🛍️ Trading Platform(s) | MT4, MT5, WebTrader, AvaOptions, AvaTradeGO, Ava Social |

AvaTrade offers traders a broad range of trading platforms, including a dedicated options trading platform and its proprietary mobile app and social trading platform. The available assets present a balanced mix, offering clients in-depth cross-asset diversification from a commission-free pricing environment.

Retail Loss Rate | 71.00% |

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.9pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | Not applicable |

Minimum Deposit | $100 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | Yes |

Inactivity Fee | $50 after three months, recurring |

Deposit Fee | No |

Withdrawal Fee | Third-party |

Funding Methods | 5 |

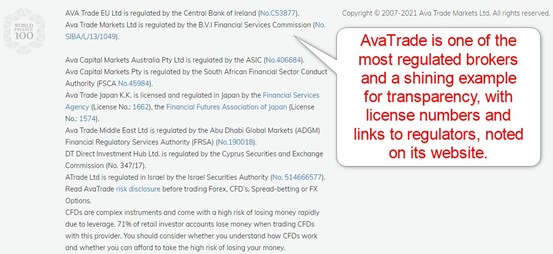

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. AvaTrade presents clients with seven well-regulated entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

Ireland

| Central Bank of Ireland | Reference Number C53877 |

The British Virgin Islands

| Financial Services Commission | License Number SIBA/L/13/1049 |

Australia

| Australian Securities and Investments Commission | License Number 406684 |

South Africa

| South African Financial Sector Conduct Authority | License Number 45984 |

Japan

| Financial Services Agency / Financial Futures Association | License Number 1662 / License Number 1574 |

United Arab Emirates (Abu Dhabi) | ADGM - Financial Regulatory Services Authority | License Number 190018 |

Israel

| Israel Securities Authority | License Number 514666577 |

The regulatory environment at AvaTrade is outstanding and one of the most trusted industry wide. AvaTrade segregates client deposits from corporate funds and offers negative balance protection. Select jurisdictions also maintain an investor compensation fund.

I want to note that the trading environments offered by these seven jurisdictions are significantly different, as the relevant regulators have varying degrees of restrictions. Since most international traders have choices, I recommend selecting the one, if possible, that is best suited to achieve your trading goals. While most beginner traders will find each regulatory environment equally satisfactory, the British Virgin Islands or South Africa may be the best suited for committed, active traders requiring higher maximum leverage.

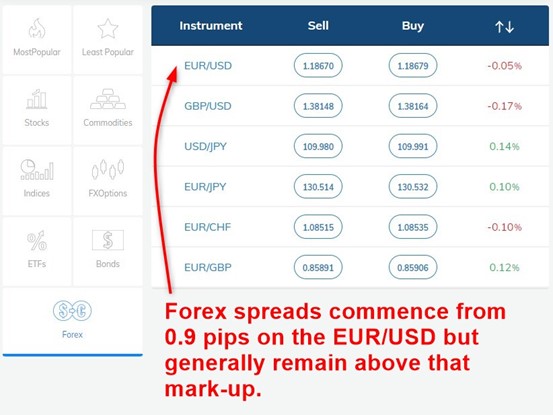

AvaTrade offers traders a commission-free pricing environment, but it comes with higher spreads. The EUR/USD starts with 0.9 pips or $9 per 1.0 standard lot.

Equity traders pay a minimum spread of 0.13%, also commission-free. Some equity traders may achieve a competitive pricing environment on select assets, dependent on trading volume and duration. Index and commodity traders get the best offer, as trading costs here rank among the best industry wide.

AvaTrade Forex spreads remain relatively higher compared to fully commission-based brokers.

Minimum Forex | Commission per Round Lot | Cost per 1.0 Standard Lot |

0.9 pips (minimum) | $0.00 | $9.00 |

1.5 pips (average) | $0.00 | $15.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free AvaTrade account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

0.9 pips

| $0.00 | -$7.58 | X | $16.58 |

0.9 pips

| $0.00 | X | -$3.62 | $12.62 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

0.9 pips

| $0.00 | -$53.06 | X | $62.06 |

0.9 pips

| $0.00 | X | $25.34 | $34.34 |

Traders must consider if the product and services portfolio at AvaTrade warrants higher trading costs, which remains an individual decision. I also want to point out the recurring inactivity fee of $50 after three months of dormancy, faster than most brokers but not an issue for active traders. After twelve months of inactivity, an administration fee of $100 applies.

AvaTrade has 55 currency pairs, 16 cryptocurrency pairs, 27 commodities, and 31 index CFDs. Equity traders get 614 assets and 58 ETFs, while 44 options and two bond CFDs complete the asset list. I like the asset selection as it remains a well-balanced choice of trading instruments, suitable for all traders.

Currency Pairs | 55 |

Cryptocurrency Pairs | 16 |

Commodities and Metals | 27 |

Index CFDs | 31 |

Equity CFDs | 614 |

Bonds | 2 |

ETFs | 58 |

Options, Futures, and Synthetics | 44 |

Maximum Retail Leverage | 1:400 (dependent on regulatory jurisdiction) |

Maximum Pro Leverage | 1:400 |

The leverage at AvaTrade depends on the regulatory jurisdictions. Most retail traders get a maximum of 1:30, in line with ESMA restrictions. Traders through the British Virgin Islands, South Africa, and professional clients qualify for maximum leverage up to 1:400.

Asset Class | From | To |

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:00 | Friday 24:00 |

Commodities | Sunday 22:00 | Friday 20:59 |

European CFDs | Monday 07:00 | Friday 15:59 |

US CFDs | Monday 13:30 | Friday 19:59 |

Please note that equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.